|

[Photo by National Pension Service] |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

South Korea’s National Pension Service (NPS) earned 57.7 trillion won ($52.2 billion) from domestic stocks last year, riding on their best performance.

A study by Seoul-based business tracker CEO Score showed Wednesday that the combined value of 275 publicly traded companies, in which the public pension fund owns 5 percent or more stake, reached 181.3 trillion won, based on the stocks’ closing price on Jan. 22. Compared to a year ago, the total value of NPS’s stock ownership increased by 57.7 trillion won or 46.7 percent.

The increase came even as NPS ownership in 5 percent or more lessened by 39 companies from a year earlier.

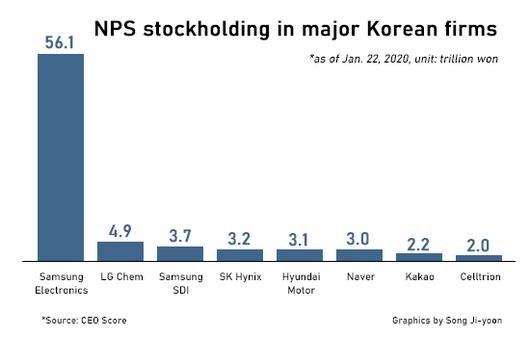

The largest contributor to the fund’s stock gains was Samsung Electronics, making up 35 percent of the total. The worth of Samsung Electronics shares that NPS owned jumped 55.7 percent to 56 trillion won last year, although the fund raised its stake in the tech giant by mere 0.08 point to 10.7 percent.

The pension fund enjoyed valuation gains of trillions of won in other tech and electric vehicle related stocks.

|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

The value of NPS’s stock holdings in electric vehicle battery makers LG Chem increased by 4.85 trillion won and Samsung SDI by 3.7 trillion won. The worth of SK Hynix shares rose by 3.2 trillion won, Hyundai Motor by 3.1 trillion won, internet giant Naver by 2.98 trillion won and Kakao by 2.2 trillion won.

Celltrion, the country’s leading biotech firm, also fared well, resulting in 1.96 trillion won stock valuation gain for NPS. The pension fund had expanded its stake in Celltrion by 1.1 percentage points last year.

NPS, however, experienced a fall in stock valuation across eight sectors. The fund had value of its holdings in energy stocks including Korea Electric Power Corp decline by 328.6 billion won, in insurance stocks by 328 billion won, and in shipbuilding/machinery stocks by 182 billion won.

NPS is the largest institutional investor in Korea and the third largest pension fund in the world. It held 785.4 trillion won assets under management as of the end of September 2020.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.