|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

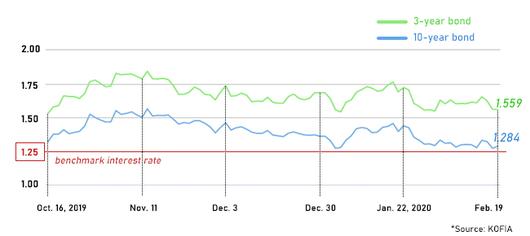

South Korea’s government debt prices have reversed direction to north as rationale for another rate cut as early as this month built up amid growing pessimism about an economic recovery in line with the rapid spread of a new epidemic.

The three-year government bond yield finished Thursday morning at 1.243 percent, below the policy rate of 1.25 percent after it was cut to the historic level in October last year. On Jan. 20, it had hovered at 1.455 percent after the central bank governor following a monetary policy meeting on Jan. 17 hinted no action for some time as data suggested signs of improvement in the economy.

That was before the new coronavirus (COVID-19) stemming from China arrived on Korean shores. The 10-year government note yielded Thursday at 1.523 percent, sharply below 1.762 percent on Jan. 20, to reflect the growing anxieties for the China-reliant economy and further dent on consumption on signs the epidemic may have broader and more lasting impact on the Korean economy.

Bond price and yield move in the opposite direction.

On Wednesday alone, 19 new virus cases were confirmed in Korea, bringing the number of infected to 51. As of Thursday, 82 have been infected, with 16 discharged from hospital.

|

[Photo by Lee Seung-hwan] |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

Few had bet on a rate move as early as this month until last week. BOK governor Lee Ju-yeol on Friday maintained addition cut must be decided “prudently” as it was too early to measure the impact from the virus outbreak on the economy.

The mood sharply reversed this week after President Moon Jae-in on Tuesday called authorities to employ “all possible” and even “unprecedented” actions to protect the economy, calling the situation “dire.”

The three-year government yield finished the day 4.9 basis points lower at 1.271 percent, and the 10-year note 6.2 basis point down at 1.560 percent.

Foreigners also turned to net buyers on renewed bet on a rate cut, with net buying of 4.61 trillion won worth futures on three-year bonds as of Tuesday. As of the end of last year, offshore investors net sold 5.64 trillion won worth for three months. The monetary meeting is held on Feb. 27.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.