|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

Shares of Hyundai Motor Co. have gained over 34 percent this month alone as the Korean automaker fared better than its global peers in the virus-battered first half and raises promising future with its EV portfolio.

Hyundai Motor on Monday and Tuesday tested 170,000 won ($143.58) for the first time since May 2017 after it finished the second quarter better than its global peers and unveiled standalone electric vehicle (EV) brand Ioniq based on much-touted self-developed EV platform.

The stocks closed Monday 15.65 percent higher at 170,000 won after gaining for six straight trading days in Seoul. Its stock leapt 34.4 percent from 126,500 won finish on July 31. Profit-taking brought the stock down to 164,500 won in the morning trade Tuesday but the stock rose further to end at 179,000 won.

The rally began after it released better-than-expected first-half results.

Hyundai Motor, Kia Motors and Tesla were the only automakers across the globe to have reported profit so far for the quarter ended June.

“Hyundai and Kia have diversified their vehicle lineup, holding up better than its global peers with new releases, recovery in domestic demand and factory activity,” said Jung Yong-jin, an analyst at Shinhan Investment Corp.

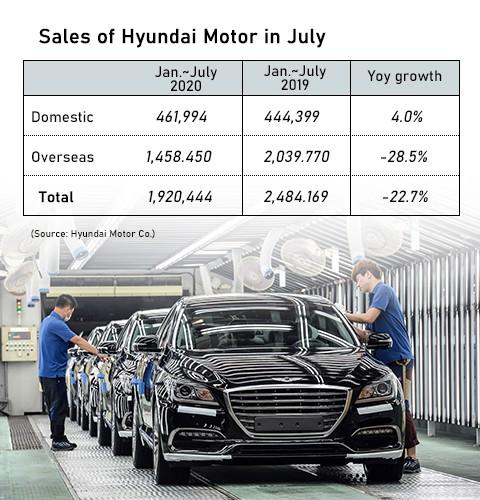

Hyundai and Kia pushed up their market dominance to 86.2 percent last month at home, up 4.3 percentage points from a year ago. Hyundai Motor sold a total of 461,994 units from January to July in Korea, gaining 4 percent on year on the back of expanded tax breaks on car purchases and new releases. Overseas shipments plunged 28.5 percent but the loss was modest when compared to industry peers.

|

Analysts now expect earnings growth of Hyundai Motor this year despite virus-led slump in the overall industry.

Hyundai Motor’s operating margin is estimated to reach 4.8 percent this year, outpacing Toyota’s 4.6 percent, Volkswagen’s 2.4 percent and GM’s 2.3 percent, according to Eugene Investment & Securities.

Last year, Hyundai Motor reported an operating margin of 3.4 percent, hovering far below Toyota’s 8.2 percent, Volkswagen’s 5.8 percent and GM’s 6.1 percent.

According to data compiled by Seoul-based financial data provide FnGuide, Hyundai Motor’s operating profit this year is projected to increase 1.81 percent on year to 3.67 trillion won despite a 2.94 percent fall in revenue.

“Most foreign brands have suspended launching new models due to worsening profits and this will help Hyundai and Kia better appeal to consumers with their new releases for a while,” Jung added.

The market also welcomed the company’s announcement on Tuesday that it will launch standalone EV brand Ioniq with an aim to sell 1 million units of EVs in 2025 to control a 10 percent market share.

|

[Photo provided by Hyundai Motor Co.] |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

All-electric vehicle brand Ioniq will be built on self-developed EV-dedicated platform E-GMP. The company plans to release mid-size cross over utility (CUV) Ioniq 5 next year, mid sedan Ioniq 6 in 2022 and large sport utility vehicle (SUV) Ioniq 7 in 2024.

Market analysts expect the new EV brand should become the Korean car giant’s new growth engine.

“Hyundai Motor and Kia Motors claimed the fourth largest 7.2 percent share in the global EV market for the first five months thanks to its quality vehicle designs and efficiency, comparable to those of EV giant Tesla,” said Lee Jae-il, an analyst at Eugene Investment & Securities.

According to driving test data obtained by Eugene Investment & Securities from the Norwegian Automobile Federation (NAF), Hyundai Motor’s Kona EV travels 547 kilometers, slightly shorter than 645 kilometers of Tesla Model S and 612 kilometers of Tesla Model 3.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.