|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

LG Corp., the holding entity of South Korea’s fourth-largest conglomerate, benefits from the group’s new identity cut to a premium brand of home appliances and maker of key parts behind new mobility.

Shares of LG have increased more than 22 percent from the beginning of the year to 110,500 won on Monday. It exceeded 100,000 won ($90.62) for the first time in 10 years since May 2011 to 107,500 won on Jan.7. It rose 10.7 percent on Jan. 4 and 10.5 percent on Jan.7.

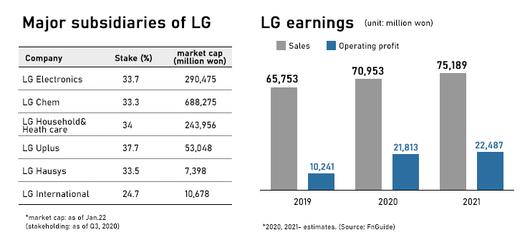

LG around 30 percent stake in core LG companies. It holds a 33.7 percent stake in LG Electronics, 33.3 percent in LG Chem, 34 percent in LG Household & Health Care, 37.7 percent in LG Uplus, 33.5 percent in LG Hausys, 24.7 percent in LG International and 33.1 percent in Silicon Works.

Its largest shareholder is chairman Koo Kwang-mo with a 15.95 percent stake.

The recent gain has been driven by the group’s bet on EVs and automotive electronics.

In November, it decided to separate four non-core subsidiaries – LG International, LG Hausis, LG MMA and Silicon Works. LG Chem spun off the battery business division and launched LG Energy Solution in the following month.

|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

LG Electronics partnered with the world’s third largest auto parts supplier Magna International to establish JV in automotive electronics. The consumer electronics giant is mulling phase-out of money-losing mobile communication (MC) division by withdrawing from lower-end smartphone business.

Market analysts value LG’s 13 subsidiaries at 45 trillion won to 50 trillion won. They believe LG, whose market cap stands at 18.5 trillion won, is undervalued even considering a holding company’s discount.

Securities companies have revised upwards their target price of LG for this year. NH Investment Securities estimate it would go up to 164,000 won, Daishin Securities 150,000 won, Samsung Securities 135,000 won, Shinhan Financial Investment 125,000 won and KB Securities 120,000.

LG is estimated to have swung to operating profit at 512.4 billion won and recorded 2.08 trillion won in revenue in the fourth quarter last year, up 25.9 percent on year, according to Seoul-based market tracker FnGuide. For the full 2020, its operating profit is projected at 2.18 trillion won on sales of 7.09 trillion won, up 113 percent and 7.9 percent, respectively, from the previous year.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.