이 기사는 2025년03월14일 07시58분에 팜이데일리 프리미엄 콘텐츠로 선공개 되었습니다.

[NA Eun-kyung, Edaily Reporter] On March 13 no South Korean pharmaceutical, biotech or healthcare stocks hit the daily price ceiling or floor. However CellBion gained double-digit percentage points standing out among the market’s movers. Meanwhile Orum Therapeutics(Orum) continued its decline with around 30% of its shares set for lock-up expiration. HLB group stocks also fell across the board as the U.S. Food and Drug Administration(FDA) decision on rivoceranib + camrelizumab approaches on March 20.

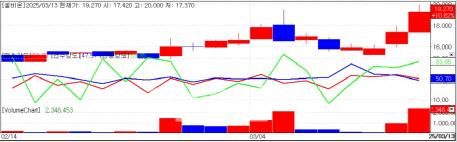

CellBion stock trend (Source: KG Zeroin MP Doctor) |

“The Market Trend Is RPT”

On March 13, radio pharmaceutical therapy(RPT) stocks showed significant gains. CellBion, which debuted on KOSDAQ last year, jumped 10.6%, while FutureChem hit an intraday high of 23,450 won before closing 0.8% higher at 22,700 won.

According to the report, both CellBion and FutureChem are in late-stage Phase 2 clinical trials in South Korea for their castration-resistant prostate cancer(mCRPC) treatments, Lu-177-DGUL and FC705, respectively. These two drug candidates have been designated orphan drugs and are eligible for the global innovative expedited review process by the Ministry of Food and Drug Safety(MFDS), allowing them to apply for conditional approval upon completion of Phase 2 trials.

FutureChem’s FC705 demonstrated a reduction in prostate-specific antigen (PSA) levels, suggesting it may match Pluvicto’s efficacy at half the dosage. CellBion aims to complete its Phase 2 trials by mid-year and launch its product in October 2024. FutureChem is conducting trials in both South Korea and the United States, with commercialization expected as early as early 2025. Both companies are seeking global licensing-out deals, with some analysts projecting potential deals in the trillion-won range.

Orum stock trend (Source: KG Zeroin MP Doctor) |

Orum Extends Decline Ahead of Lock-Up Expiration

Orum Therapeutics which listed on KOSDAQ on Feb. 14, once peaked at 42,250 won but has struggled amid selling pressure. With 28.91% of total issued shares set to be released from the lock-up period on March 14, the stock has continued to decline.

Investor expectations remain high regarding potential major licensing deals later this year. Orum’s pre-IPO investment prospectus indicated that it anticipates securing an additional global tech transfer deal this year, with an upfront payment of about 23.5 billion won.

This anticipated deal centers on TPD², the company’s proprietary targeted protein degradation (TPD) platform, which it successfully licensed out to Vertex Pharmaceuticals last year.

An Orum spokesperson said “The deal referenced in the investment prospectus pertains to TPD². We are actively engaged in business development discussions with potential partners, but we cannot disclose details on the progress.”

With just one week remaining before the FDA’s new drug application decision on the rivoceranib + camrelizumab combination therapy for liver cancer, HLB Group stocks have been volatile.

On March 13, all 11 HLB Group stocks declined, including Anygen, a company HLB recently announced plans to acquire.

Key declines among HLB Group stocks △HLB -5.5% to 74,200 won △HLB Therapeutics -9.2% to 8,080 won (largest decline in the group) △HLB Life Science -8.6% △HLB Pharma -6.8% △HLB Biostep -5.1% △HLB Global -4.6% △HLB Science -0.5% (smallest decline).

HLB Life Science holds South Korean marketing rights for rivoceranib. HLB Pharma plans to seek regulatory approval from South Korea’s Ministry of Food and Drug Safety and handle domestic production and marketing if the FDA grants approval.

Other HLB affiliates have invested in rivoceranib’s development, sharing the financial burden. The FDA’s ruling on rivoceranib + camrelizumab is considered one of the most significant events for South Korea’s biotech sector in the first half of 2024. If approved HLB aims to launch the drug in the U.S. by the third quarter.

An HLB spokesperson cautioned against speculation saying “As the NDA decision date approaches, rumors will intensify. The FDA has not made any decision yet. We will announce the official decision on YouTube as soon as we receive notification, so please do not be swayed by unfounded rumors.”

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.