In 2023, Alteogen posted revenue of 102.8 billion won and operating profit of 25.4 billion won, marking its return to profitability after nine years. The company is expected to maintain its positive earnings trajectory this year, bolstered by this latest partnership.

Why AstraZeneca Chose Alteogen

According to industry sources on Tuesday, Alteogen on March 17 entered into a license agreement with MedImmune, a subsidiary of AstraZeneca, for its proprietary ‘Hybrozyme’ SC platform technology. The deal is valued at $1.3 billion, or about 1.9 trillion won.

Breakdown of the deal suggests that Alteogen will receive approximately 36.5 billion won in upfront payments across two agreements with the U.K. entity and another 29 billion won from the U.S. entity. The latter is expected to focus on a commercial-stage asset, while the U.K. entity is targeting two clinical-stage assets.

|

Soon-Jae Park, CEO of Alteogen (Photo: Edaily DB) |

MedImmune typically uses the prefix ‘MEDI’ for its development codes, leading industry watchers to speculate that the U.S. project involves durvalumab (Imfinzi), AstraZeneca’s PD-L1 immunotherapy. The two clinical assets under the U.K. unit are presumed to be Volrustomig, a PD-1/CTLA-4 bispecific antibody, and Oleclumab, a CD73-targeting monoclonal antibody. Notably, this would mark the first SC formulation deal for each pipeline, potentially echoing the success of Halozyme and J&J’s SC version of amivantamab, which improved both efficacy and safety.

“The collaboration with AstraZeneca marks a major milestone in advancing our future growth potential,” said Alteogen CEO Soon-Jae Park. “We remain committed to delivering improved treatment options for patients.” He added.

AstraZeneca’s key motivation for partnering with Alteogen lies in the technical strength of ALT-B4, a platform that converts intravenous (IV) formulations into more convenient subcutaneous injections. SC formulation strategies are a preferred route for global pharma companies seeking to extend product exclusivity beyond IV patent expirations. Developing SC versions often allows firms to secure new patents, effectively prolonging market monopoly.

AstraZeneca faces increasing pressure to advance its SC conversion efforts. Roche’s SC version of Tecentriq captured 32% of the U.K. market within just three quarters of launch. SC development of Imfinzi has thus become imperative for the company.

The licensing agreement is viewed by analysts as an endorsement of Alteogen’s validated technology. Following similar long-term deals with Merck & Co. and Daiichi Sankyo, AstraZeneca’s commitment suggests the platform has cleared major IP hurdles.

“A big pharma company with rigorous risk management processes choosing to license this technology to extend patents for key revenue-generating drugs makes the possibility of unresolved Halozyme-related disputes very slim,” said an Alteogen spokesperson.

Revenue Outlook Strengthens

Beyond the sizable upfront payment, the deal opens up opportunities for milestone and royalty revenues during development and commercialization. Should ALT-B4 be successfully commercialized, Alteogen expects to secure steady royalty income streams.

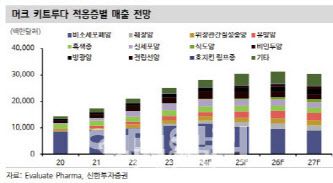

Alteogen is also poised to receive $1.05 billion in milestones between 2026 and 2030 from its SC platform license for Merck’s blockbuster cancer drug Keytruda.

|

Keytruda Sales Forecast (Source: EvaluatePharma, Shinhan Investment Corp.) |

Market analysts see the AstraZeneca deal as not only reaffirming the technology’s strength but also easing investor concerns over potential patent litigation. The removal of such uncertainty is expected to improve the outlook for additional licensing opportunities.

Alteogen aims to secure at least two more major global licensing deals in 2025. The company is also reportedly exploring a possible revision of its SC formulation deal with Sanofi for Dupixent.

“This partnership with a global leader in innovative therapeutics represents a significant advancement for Alteogen,” Park said. “We are hopeful that rapid development will lead to improved treatment options and enhanced patient quality of life.”

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.