Semiconductor profit falls to $769 million despite solid overall farnings

|

Samsung Electronics’ Seocho office building in Seocho-gu, Seoul. |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

|

Graphics by Chung Seo-hee |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

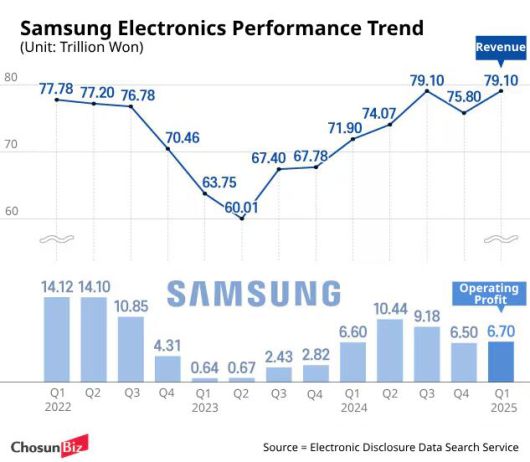

Samsung Electronics logged 1.1 trillion won ($769 million) in operating profit from its flagship semiconductor division in the first quarter of 2025, slipping back into the 1-trillion-won range for the first time in a year. Although the figure exceeded market forecasts, which had hovered around 600 billion won, it was just one-seventh of the 7.44 trillion won ($5.2 billion) reported by rival SK hynix, underscoring Samsung’s weakest performance since the global chip slump of 2023.

On Apr. 30, Samsung announced consolidated sales of 79.14 trillion won ($55 billion) and operating profit of 6.7 trillion won ($4.6 billion) for the January–March period. Revenue climbed 10.05 percent from a year earlier, while operating profit rose 1.2 percent. Both figures beat analysts’ projections, with quarterly revenue reaching an all-time high. The strong performance was attributed to robust sales of the Galaxy S25 smartphone, early bulk purchases of general-purpose memory chips amid U.S. tariff moves, and favorable exchange rates.

Still, concerns are mounting over the performance of Samsung’s semiconductor business, long considered its core engine. The Device Solutions (DS) division, which handles chip operations, posted revenue of 25.1 trillion won ($17.5 billion) and operating profit of 1.1 trillion won ($769 million). While Samsung does not provide a breakdown by sub-unit, analysts estimate that the memory segment alone generated approximately 3 trillion won ($2.2 billion) in profit—only half the level achieved by SK hynix.

Samsung’s struggle to supply fifth-generation high-bandwidth memory (HBM) chips to key client Nvidia, coupled with an estimated 2 trillion won ($1.3 billion) in combined losses from its foundry and system large-scale integration (LSI) businesses, dragged down overall profitability.

SK hynix, meanwhile, extended its lead in the fast-growing AI chip component sector. With a share exceeding 50 percent of the global HBM market, it outperformed Samsung’s entire semiconductor division for a second consecutive quarter. Adding to the setback, Samsung lost its decades-long lead in dynamic random-access memory (DRAM) to SK hynix during the first quarter. Market tracker Counterpoint Research reported that SK hynix captured 36 percent of the global DRAM market, ahead of Samsung at 34 percent and U.S.-based Micron at 25 percent.

In contrast, Samsung’s smartphone division delivered solid results despite a challenging market environment. The Galaxy S25 became the fastest-selling Galaxy model to date, with domestic sales surpassing 1 million units in just 21 days. A decline in memory prices at the end of last year also contributed to improved profit margins. Operating profit from the Mobile eXperience (MX) and network businesses rose to 4.3 trillion won ($3 billion), up 800 billion won ($559 million) from a year earlier.

The Visual Display (VD) and home appliance divisions, responsible for TVs and other consumer electronics, posted a combined operating profit of 300 billion won ($220 million). That marked an improvement from the previous quarter’s 200 billion won ($139 million), driven by stronger sales of high-end products such as Neo QLED and OLED TVs and cost reductions. However, earnings still fell short of the 530 billion won reported in the same period last year.

Samsung Display also fell short of expectations, with operating profit dropping to 500 billion won ($349 million)—about half the level recorded in the previous quarter. The decline was attributed to seasonal weakness in sales of small and mid-sized panels, which are its main revenue sources. While some competitors benefited from inventory restocking prompted by U.S. tariffs, Samsung did not see a similar uptick.

Looking ahead, the outlook for the second quarter remains uncertain amid escalating U.S.-led trade restrictions. Samsung Electronics said, “With growing macroeconomic uncertainty stemming from deteriorating global trade conditions and slowing economic growth, it is difficult to forecast future earnings,” adding that “if these uncertainties ease, performance is expected to improve in the second half of the year.”

[Hwang Min-gyu]

- Copyrights ⓒ 조선일보 & chosun.com, 무단 전재 및 재배포 금지 -

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.