이 기사는 2025년03월19일 08시44분에 팜이데일리 프리미엄 콘텐츠로 선공개 되었습니다.

[Seok Ji-heon, Edaily Reporter] On March 18, Jeil Pharmaceutical and its subsidiary, Onconic Therapeutics, both hit the upper price limit after announcing that their investigational drug was designated as an orphan drug by the U.S. Food and Drug Administration (FDA). Novmeta Pharma, a biotech company, surged nearly 10% following news that it had recruited a key executive to finalize a major deal. Kolon TissueGene also jumped more than 14% on expectations surrounding FDA approval for its osteoarthritis gene therapy, TG-C.

‘Another Recognition of Technological Innovation’

According to KG Zeroin’s MP Doctor (formerly MarketPoint), Jeil Pharmaceutical closed at KRW 13,520, up KRW 3,120 (30%) from the previous trading day. Its subsidiary, Onconic Therapeutics, ended at KRW 18,040, up KRW 4,160 (29.97%). The holding company, Jeil Pharma Holdings, also climbed 14.6% to KRW 8,400.

Jeil Pharmaceutical stock trend (Source: KG Zeroin MP Doctor) |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

Onconic Therapeutics received an orphan drug designation (ODD) from the FDA for its next-generation synthetic lethal dual-target oncology candidate, “Nesuparib”, aimed at treating gastric and gastroesophageal junction cancer.

Nesuparib inhibits two proteins, PARP (Poly ADP-ribose polymerase) and Tankyrase, both crucial for cancer cell survival, making it a next-generation targeted anticancer agent.

A Jeil Pharmaceutical representative commented on the stock’s rise: ‘If Nesuparib’s market value is fully recognized, it will drive corporate growth. By securing revenue through proprietary drugs and continuing new drug research, we anticipate a corporate value re-evaluation.’

Onconic is currently conducting a Phase 1b/2 clinical trial for pancreatic cancer and a Phase 2 investigator-initiated trial for endometrial cancer in combination with Keytruda. The latest orphan drug designation suggests that Onconic may soon enter clinical trials for gastric cancer as well. The company is scheduled to present its Nesuparib research findings at the American Association for Cancer Research (AACR) 2025 in April.

Boost to License-out and Investment Efforts

stock trend (Source: KG Zeroin MP Doctor) |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

According to the report, Novmeta Pharma has brought in a key figure to complete a major deal. At its March 24 shareholder meeting, the company will vote on appointing Stuart Peltz, former CEO of PTC Therapeutics, as an internal director. Peltz was a founding member of PTC, which went public on NASDAQ in 2013, and served as CEO until 2023. During his tenure, he secured investment from BlackRock and helped PTC grow into a global biotech firm with 1,700 employees.

One of his most notable achievements was the commercialization of Evrysdi (risdiplam), an oral treatment for spinal muscular atrophy (SMA), which was licensed out to Roche. Peltz played a pivotal role in its development, licensing, and commercialization. Evrysdi received FDA approval in 2020 and has since become a blockbuster drug, generating CHF 1.6 billion (approximately KRW 2.6 trillion) in revenue in 2023.

Peltz will oversee Novmeta Pharma’s global business operations. Joining him is Kylie O’Keefe, PTC’s former Chief Commercial Officer (CCO), who led global commercialization strategies for six rare neurological and metabolic disease products across 50+ countries. At Novmeta Pharma, she will serve as Chief Operating Officer (COO).

Novmeta Pharma’s Vice President Heon-jong Lee stated, ‘With these globally recognized experts on board, confidence in our technology has grown significantly. Their expertise will be crucial in advancing and commercializing novel muscle disorder treatments.’

The company aims to focus on license-out deals and attracting investment, with plans to reattempt a KOSDAQ listing in the second half of the year.

Pioneering the First Osteoarthritis Disease-Modifying Drug

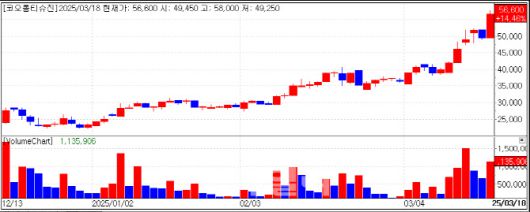

The stock has been on an upward trajectory, rising approximately 134% since the beginning of the year. Kolon TissueGene completed large-scale Phase 3 dosing for TG-C in 2024 and plans to file a Biologics License Application (BLA) with the FDA by 2026 following patient follow-ups.

Kolon TissueGene stock trend (Source: KG Zeroin MP Doctor) |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

TG-C is a cell-based gene therapy that provides up to two years of pain relief and improved joint function with a single injection. The company highlighted its superior efficacy, with a 86% response rate in Phase 2 trials, outperforming existing treatments.

Kolon TissueGene aims to obtain disease-modifying osteoarthritis drug (DMOAD) status from the FDA upon approval. Currently, no osteoarthritis drug has received DMOAD designation.

In a corporate report, Korea Investment & Securities analyst Hae-joo Wi stated: “If TG-C is approved as a disease-modifying osteoarthritis drug, sales could reach $7-8.2 billion, with an estimated operating profit of KRW 5.5 trillion.”

Commenting on the stock’s rise, a Kolon TissueGene spokesperson said: ‘Following our acquittal last November, market trust in the company has been restored. Recent U.S. media briefings have likely fueled optimism regarding TG-C’s FDA approval prospects.’

TG-C was originally launched in South Korea in 2017 but had its approval revoked in 2019 due to incorrect documentation on cell origins. The company has been involved in ongoing legal proceedings, though a 2023 criminal trial ruled in its favor.

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.