Misleading business claims deepen ‘Korea Discount’

|

Illustrated by Park Sang-hoon |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

South Korean listed companies are under fire for issuing exaggerated or false public disclosures about new business ventures, drawing comparisons to the tale of “The Boy Who Cried Wolf.” Experts warn that such practices erode trust in the stock market. Excessive clarifications and corrections to rumors and news reports are also being blamed for exacerbating the so-called “Korea Discount,” a term describing the persistent undervaluation of South Korean equities. Critics argue that a reliance on speculation in the domestic stock market, alongside corporate moves such as spin-offs and dual listings that alienate minority shareholders, is deepening the issue.

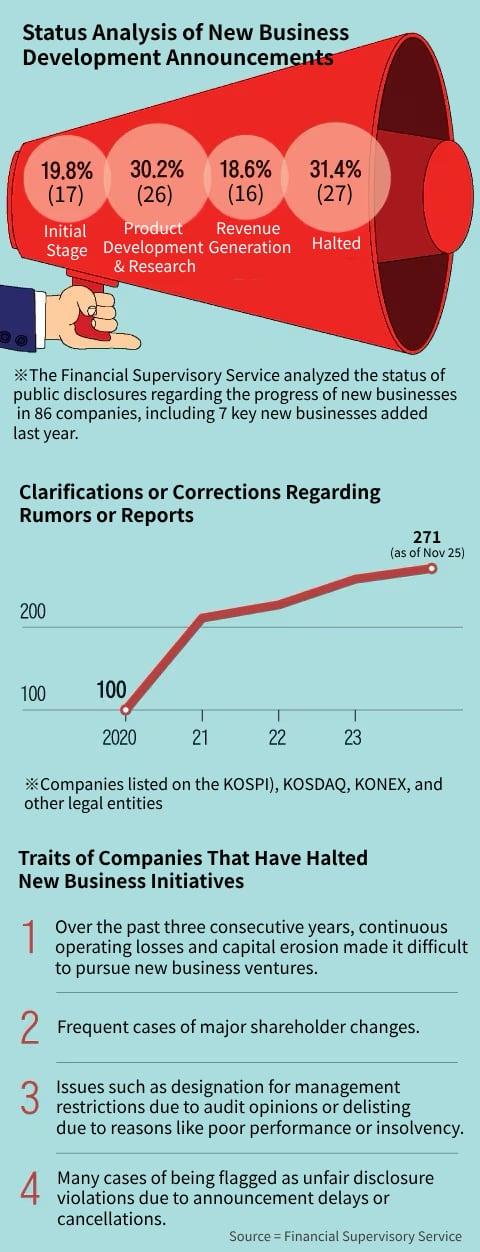

According to the Financial Supervisory Service (FSS), an analysis of public disclosures on new business developments by 86 listed companies that announced entries into seven key sectors last year—including secondary batteries, artificial intelligence (AI), and the metaverse—showed that 27 companies (31.4%) had made no progress, while only 16 companies (18.6%) generated any revenue from these initiatives.

The FSS highlighted several cases of misleading disclosures exploiting trending topics. For instance, at the onset of the COVID-19 pandemic in 2020, Company A claimed to have secured a large-scale mask supply contract, projecting significant profits. The company later announced vaccine-related business objectives and appointed a founding member of a major global biotech firm to its board. However, investigations revealed that the company had no involvement in mask or vaccine-related ventures. The FSS determined that these announcements were fabricated to manipulate the company’s stock price.

In another example, Company B issued press releases claiming to have signed a memorandum of understanding (MOU) for COVID-19 vaccine research and development. However, the FSS found no substantive progress, concluding the MOU was a tactic to falsely suggest business advancement. “It is not uncommon for companies to issue misleading disclosures about entering trending industries, even when these ventures have no connection to their existing operations,” an FSS official stated.

Observers note that South Korea’s stock market is highly influenced by thematic narratives and unverified rumors, fostering an environment ripe for speculative disclosures. According to LS Securities, companies listed on the Korea Exchange (KOSPI), Korea Securities Dealers Automated Quotation (KOSDAQ), Korea New Exchange (KONEX), and other boards issued 271 clarification disclosures regarding rumors or news reports on the FSS’s electronic disclosure system as of Nov. 25. This figure already exceeds last year’s record of 258 such cases. The number of clarification disclosures has risen dramatically in recent years, from 66 in 2019 to 100 in 2020 and 211 in 2021.

|

Graphics by Park Sang-hoon |

“The sharp increase in clarification disclosures underscores how vulnerable the domestic stock market is to unverified rumors, which drive significant stock price volatility,” said a source in the securities industry. “It also reflects the ongoing lack of investor confidence in the local market.”

[Kim Seung-hyeon]

- Copyrights ⓒ 조선일보 & chosun.com, 무단 전재 및 재배포 금지 -

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.